27 Aug $1 MILLION IN UNCASHED CHECKS AND THREE HANDWRITTEN “WILLS”, ARETHA FRANKLIN’S ESTATE IN CHAOS ONE YEAR AFTER HER DEATH

“Sock it to me, sock it to me” are part of the famed lyrics of Aretha Franklin’s hit song, “RESPECT”, but her lack of estate planning has landed a haymaker to the previously closely-knit heirs of the late songstress who died a little over a year ago.

When Aretha Franklin died in August of 2018, it was originally thought she had no Will so her assets would pass under the laws of intestacy (when the deceased dies without a Will) in the state of Michigan, where she resided. As a result, it was thought that her four sons would equally inherit her estate (which would also be the case under Texas law assuming there are no other surviving children) that could be worth hundreds of millions of dollars. The four sons agreed to appoint their cousin, Sabrina Owens, as the personal representative.

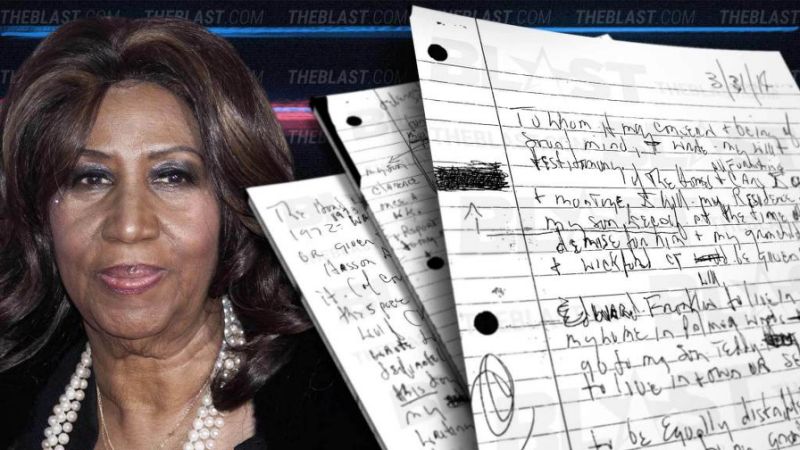

Harmony was thrown topsy-turvy when three handwritten documents (including one found under the couch cushions) alleged to be her Will were filed with the Michigan court a few months ago.

Since each Will (under Michigan law, a handwritten Will may be admitted to probate without witnesses if it is signed, dated and in the handwriting of the deceased) varied how her assets are to be distributed, Aretha Franklin’s sons are now bickering for control and on issues ranging from competence (her eldest son lives in a group home) to who gets to drive her Mercedes-Benz. One son has already accused their personal representative cousin, Sabrina, of ”self-dealing” by driving the Mercedes-Benz and of mismanagement and has asked the court that he be named as personal representative since it is still not fully known what assets Ms. Franklin had at the time of her death. The court denied that son’s request to be personal representative as it was noted he had already borrowed from the estate to pay for legal representation due to his arrest for driving while intoxicated.

During an inventory, approximately $1 Million in uncashed checks were found. Usually you only have six months to cash a check. The personal representative could ask the checks be re-issued, however, it is uncertain at this time if that will happen as there is a fight on even who can act on behalf of the estate. A personal representative is needed to be able to establish an account and deposit the checks if checks are re-issued.

The financial impact on who is in charge and who manages the estate is crucial. As an example, the estate of Elvis Presley was greatly enhanced by proper management. MGM is already devoting a scripted series on Franklin to be aired on the National Geographic Channel.

Ten (there are more) of the lessons learned, by Ms. Franklin’s actions or inactions:

- She could have reduced risk of family fighting and a contest. Her actions or inactions have possibly torn her family asunder.

- Her estate could have had privacy by the use of a trust.

- She could have reduced her taxes.

- She could have protected any children that are spendthrifts and need creditor protection.

- She could have protected her child who can’t handle his assets due to his mental deficiencies.

- Even if one of her handwritten “Wills” are accepted by the court, it has substantially increased legal fees and time to distribute her assets.

- Professional management of assets could have already been established for the benefit of the estate and its beneficiaries.

- There is less likelihood that there would be $1 Million of uncashed checks that were not deposited over a year after her death.

- She could have reduced risk of mismanagement by a personal representative by language in a Will or trust by giving a trusted party the ability to remove a personal representative without court intervention.

- She could have protected beneficiaries if they were having marital issues at the time of her passing.

If interested in learning more, consider attending our next free “Estate Planning Essentials” workshop by calling us at (214) 720-0102 or sign up by clicking here.